When it comes to managing your finances, having a tool that makes it easy to track all of your accounts in one place and set and track budgets is essential.

Mint and Monarch Money are two of the most popular options on the market, but which one is better? As someone who has used both extensively, see how they stack up!

If you need to sync a lot of unique accounts… Monarch Money

One of the biggest strengths of Monarch Money is its ability to sync with over 11,000 banks and institutions, making it easy to track all of your accounts in one place. Mint has a similar feature, but it doesn't sync with as many institutions and updates far less frequently.

In my experience, I found that Monarch Money was able to track all of my accounts more accurately, including some that Mint couldn't connect with.

If you want the clearest view of your financial picture… Monarch Money

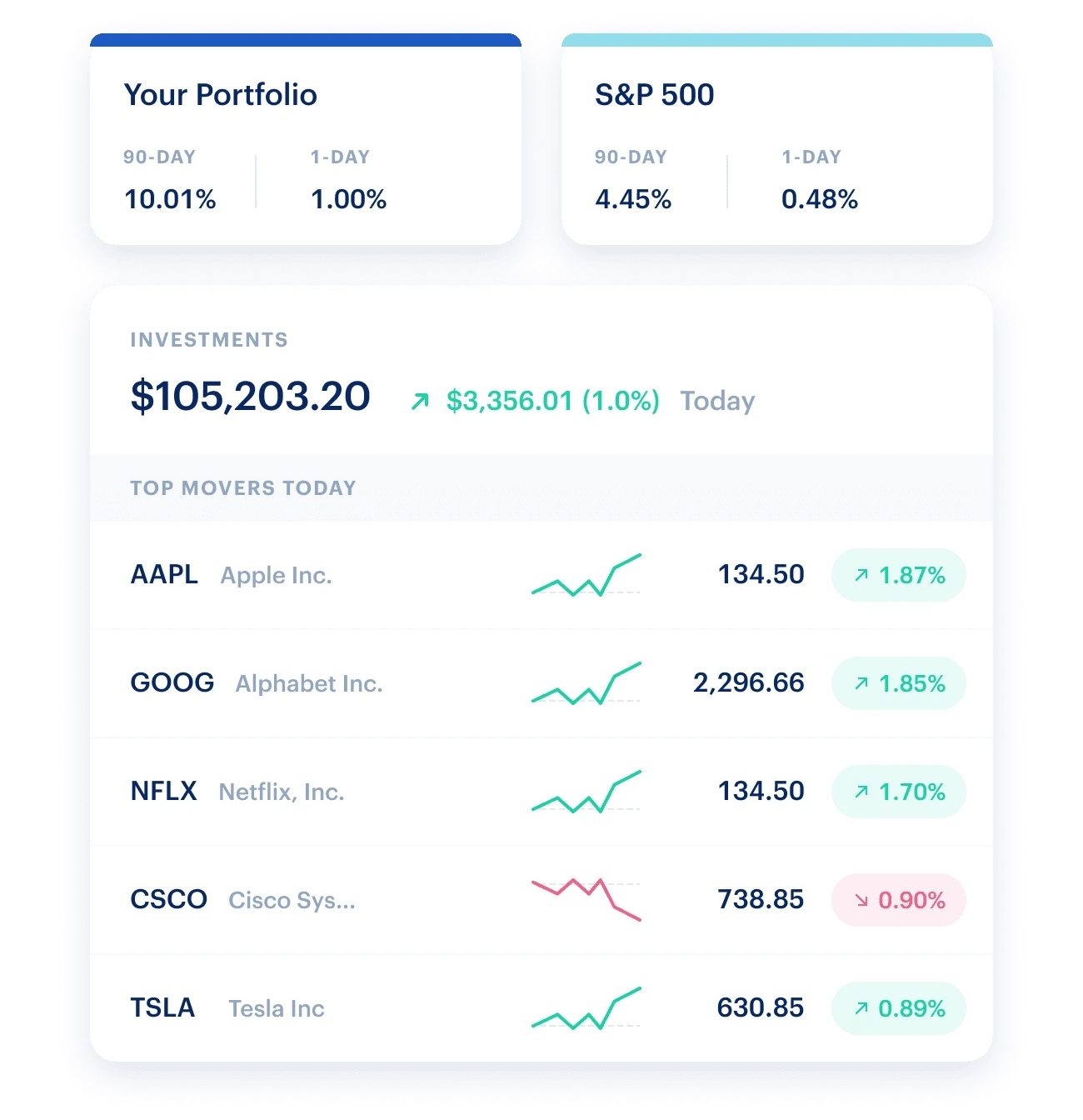

Having an up-to-date view of your financial picture is crucial for making informed decisions. Both Mint and Monarch Money provide this feature, but Monarch’s presentation is more user-friendly and customizable.

The dashboard and charts in Monarch Money are easy to read and can be tailored to your preferences, while Mint's dashboard can be cluttered and difficult to navigate.

If you’re looking to collaborate with a partner… Monarch Money

Both Mint and Monarch Money offer collaboration features, making them a great choice if you want to share your financial information with a partner. Mint allows you to share access to your account with a partner, while Monarch Money offers a joint account option.

While both options provide basic collaboration functionality, I prefer Monarch's joint account feature. With Monarch Money, each person has their own login and can attach their own separate accounts, which provides more flexibility and allows each collaborator to see how they're doing individually on their finances, as well as together.

If you want the best planning and advice… Monarch Money

Long-term financial planning and personalized advice are two of the key features that set Monarch Money apart from Mint. With Monarch Money, you can create a financial plan that takes into account your goals and values, and access personalized financial advice. Mint, on the other hand, offers more basic budgeting tools and doesn't provide personalized advice.

If you're looking for a free app… Mint

While Mint offers all of its features for free, it comes at the cost of having ads that can clutter the platform and be distracting. This can be frustrating, especially if you're trying to focus on your finances. In contrast, Monarch Money's design is modern, intuitive, and ad-free.

The clean interface is easy to navigate, which can make managing your finances a more enjoyable experience. While Monarch Money does require a low-cost subscription, the added benefits of a clean interface and an ad-free platform make it worth the investment.

Overall Winner… Monarch Money

While both Mint and Monarch Money offer some useful features, Monarch Money's strengths in account tracking, financial picture presentation, planning and advice, and bank-level security and design make it the clear winner in my book.

If you're looking for a comprehensive financial tool that can help you achieve your goals, Monarch Money is the way to go!